Home > Trading > Settlement procedure

Settlement procedure

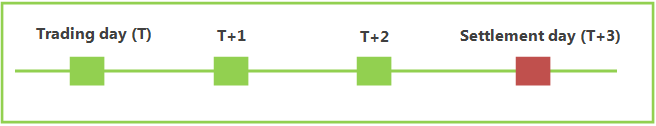

Share transactions at YSX is settled in three business days and this settlement cycle is called as “T+3 settlement (trade date plus three business days)”. Settlement arising from the share transactions is conducted between YSX and securities companies (“SCs”) through the process in transfer institutions.

T+3 settlement

Clearing process

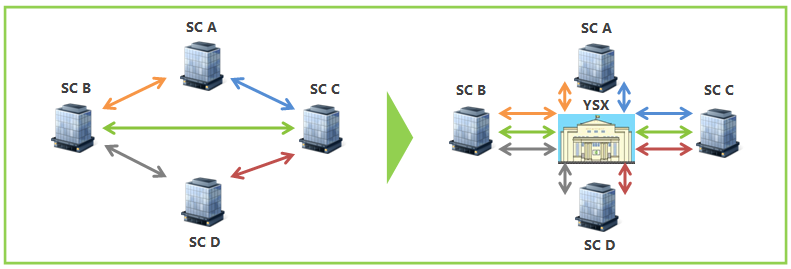

Central Counter Party

-

YSX works as a clearing institution, a Central Counter Party (“CCP”), according to section 51 of the Securities Exchange Law.

-

YSX calculatestrading position of each SCand replace claims and obligations between SCs into ones between each SC and YSX in a scheme of novation.

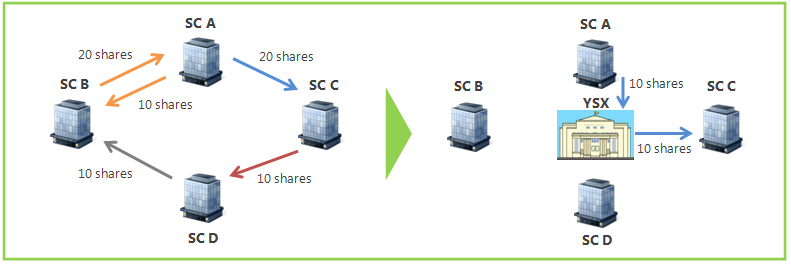

Netting

-

YSX offsets claims and obligations between YSX and SCs in a netting processon a multilateral basisand reduces settlement risks associated with stock trading.

Transfer instruction

-

After netting process with fixing the amounts of securities and funds to be deliveredfrom/to SCs, YSX gives transfer instruction to the transfer institutions for settlement procedure on T+2 day after stock trading.

Settlement process

Transfer institutions

-

YSX is the transfer institution for securities settlement and a fund settlement bank, KBZ Bank Ltd., is atransferinstitution for fund settlement.

-

Securities and fund settlement are conducted account transfer, book-entry transfer, between YSX and each securities company in the transfer institutions.

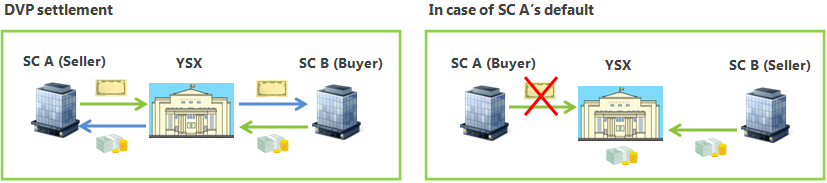

DVP settlement

-

To prevent a loss of principal, DVP (Delivery Versus Payment) settlement is introduced in the settlement scheme.

-

Shares are delivered on the condition that the corresponding cash payment is completed in case of a net buyer securities company while cash payment are received on the condition that the corresponding shares are delivered in case of a net seller securities company.

Securities settlement

-

Share certificates of listed companies become invalid when a company gets list on YSX and shareholders information is registered as electronic data in YSX and SCs ICT system (“script less” or dematerialization scheme”).

-

Share transfer arising from stock trading at YSX is conducted through a process of increasing or decreasing of the numberof shares registered in YSX and SCs ICT system on T+3 day.

Fund settlement

-

Cash payment arising from stock trading at YSX is conducted between settlement bank account between YSX and SCs with a fund settlement bank on T+3 day.

Contact:

Market Department

Tel: 01-371167