Home > Trading > Trading procedure (For Foreigner)

Trading procedure (For Foreigner)

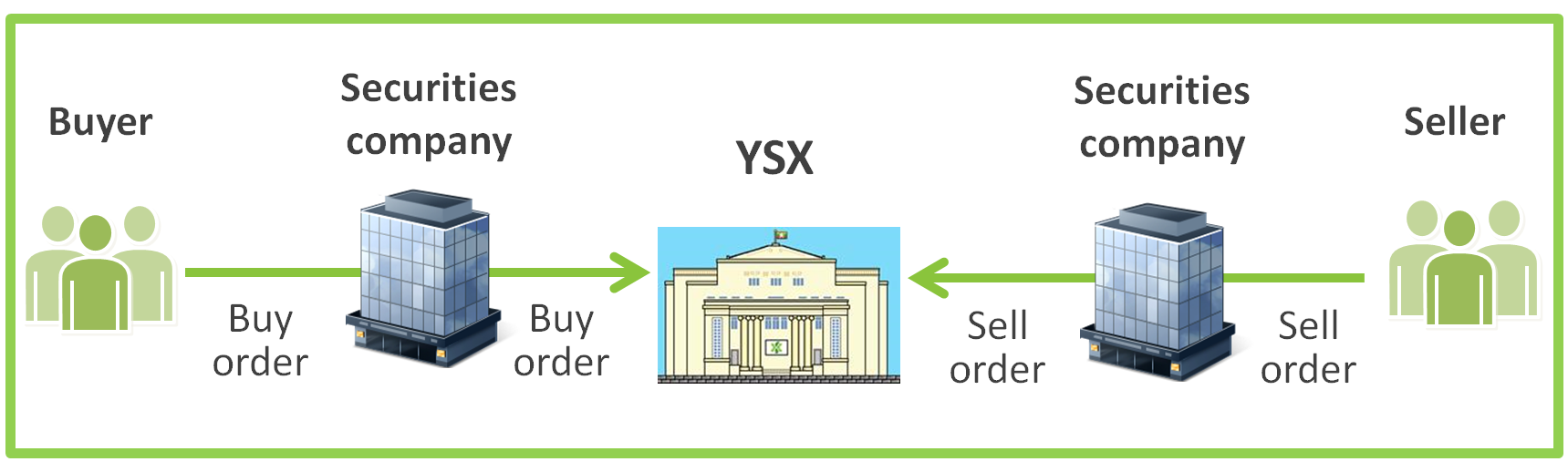

YSX, as a stock exchange, is a venue to provide opportunities for investors to buy or sell listed company’s shares. Investors have to send their buying or selling orders to YSX through securities companies having securities license issued by SECM as well as trading qualification provided by YSX.

Getting ready

Choosing a securities company

-

Choosing a Securities Company, having securities license and trading qualification, for opening a securities account.

-

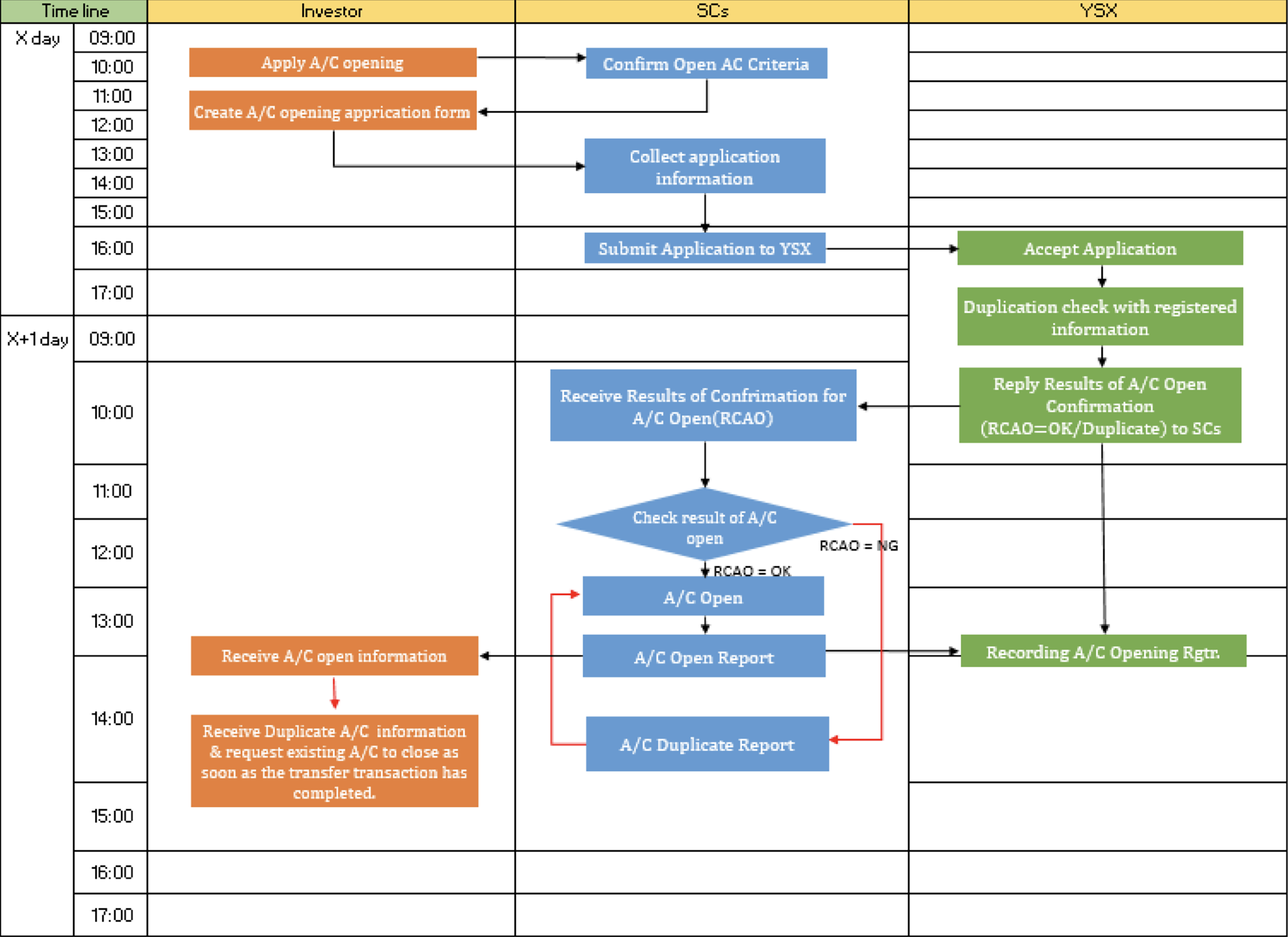

Investor needs to visit preferable securities company and submit the application form to open securities trading account.

-

A Securities Company will issue the Recommendation Letter on next business day, which enable applicant to open special bank accounts for securities trading in Myanmar.

-

A Securities Company will check with YSX whether the applicant has duplicate securities account

Bank account

-

With the recommendation Letter from respective SC, applicant can open special bank accounts for securities trading in Myanmar.

-

After applicant opened the special bank accounts for securities trading, Securities Account will be opened at respective SC.

Securities Account Opening

-

Required Documents for Applicant who does not reside in Myanmar

-

Passport

-

Any ID issued in respective country with the face photo (any language)

-

-

Required Documents for Applicant who resides in Myanmar

-

Passport

-

Any ID issued in respective country with the face photo (any language)

-

Stay permit (or) residence contract in Myanmar

-

-

Required Documents for Corporate (English written ONLY)

-

Company Registration Certificate

-

BOD Resolution (or) its equivalent letter to resolve to open Securities Account at any of Securities Companies

-

List of Directors including name & address and their ID

-

List of Major Shareholders and their ID

(Major Shareholder means one who owns more than 10% share of respective applicant corporate) -

Authorization letter to appoint that respective trading person and their ID.(2 trading persons can be registered at most)

-

Copy of Company Constitution

-

Investment decision

-

To decide, with receiving investment advice from securities companies, which stocks, how match price, how many shares and what timing an investor places buy/sell order, through a securities company, on YSX.

-

The final investment decision should be done by an investor and the investor has responsibility for the decision of stock trading and order placement by himself/herself.

Stock trading rules

After opening bank and securities accounts, an investor is able to send buying/selling orders under following stock trading rules stipulated in the Trading Business Regulations:

Trading hours

| Order acceptance time | 9:30 am to 1:00 pm |

| Matching time | 10:00 am, 10:30 am, 11:00 am, 11:30 am,

12:00 pm, 12:30 pm and 1:00 pm |

Order types

-

Market order

-

A market order is an order placed without specifying the buying or selling price.

-

Even though a market order has price priority than other limit orders and is likely to be executed, the order has risk which an investor may buy or sell shares at his/her unexpected higher or lower matching price.

-

-

Limit order

-

A limit order is an order placed by specifying the price at which the trader seeks to buy or sell shares.

-

Even though an investor placing a limit order can avoid risk of buying/selling shares at unexpected price, an investor cannot buy/sell shares if a matching price is superior than his/her limit order price.

-

Price limit

-

To prevent too much volatility of stock prices, YSX sets daily price limit for all stocks of listed companies.

-

An upper and a lower limit price of the day is decided based on a level of a base price under the table stipulated in the Enforcement Regulations for Trading Business Regulations. A base price, in general, is the last matching price of a previous working day.

-

In case where a base price is MMK 35,000, an upper limit price becomes MMK 40,000 (MMK +5,000) and a lower limit price becomes MMK 30,000 (MMK -5,000)

(Excepted price limit table)

| Base price (MMK) | Price limit (MMK) | |

|---|---|---|

| From (≧) | Below (<) | |

| 10,000 | 20,000 | 2,500 |

| 20,000 | 40,000 | 5,000 |

| 40,000 | 100,000 | 10,000 |

| 100,000 | 200,000 | 25,000 |

Reference: Enforcement Regulations for Trading Business Regulations

Order unit and tick size

-

Order unit, which is a minimum amount of shares an investor is able to place on YSX’s order books of listed companies, is one (1) share.

-

A tick size is the minimum stock price movement of stocks of a listed companies and the tick size is decided based on tick size table stipulated in the Enforcement Regulations for Trading Business Regulations.

(Excepted tick size table)

| Order price (MMK) | Tick size (MMK) | |

|---|---|---|

| Above (>) | Up to (≦) | |

| 10,000 | 40,000 | 500 |

| 40,000 | 100,000 | 1,000 |

| 100,000 | 400,000 | 5,000 |

Reference: Enforcement Regulations for Trading Business Regulations

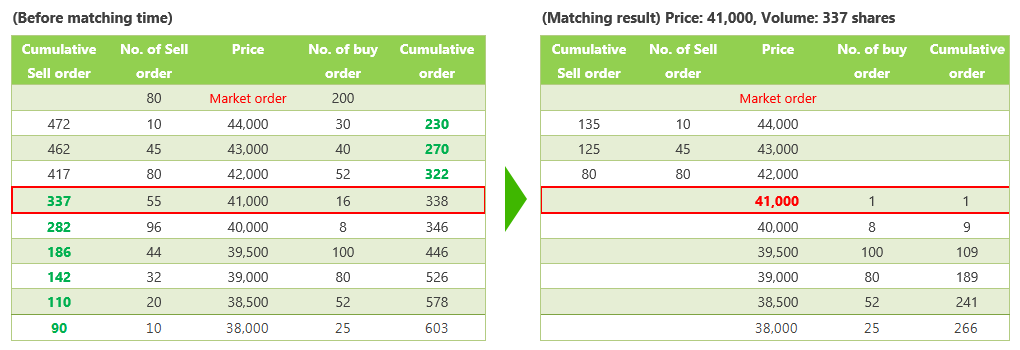

Matching methods

-

Price priority: The order price that is superior than other orders gets filled first and a market order has the first price priority.

-

Time priority: If the price priority is same, earlier order has priority to get filled first.

-

Call auction methods:

-

For each limit price recorded in the order book, the system calculates the cumulative amounts in each buy and sell order book side.

-

For a market order, each buy/sell market order is placed on the cumulative buy/sell order column of the upper limit price/lowest limit price with the superior price priority than the limit orders.

-

Comparing the totals of each order book side, a matching price is determined in the price allowing the largest number of stocks to be traded. Then, all the stocks are filled at this matching price.

-

If there are two candidate prices to be a matching price, a closer price with the last matching price or a base price becomes a matching price

-

Placing orders and order matching

-

An investor is able to send his/her orders, through a securities company, to YSX anytime during trading hours and orders are filled if the orders satisfy matching requirement mentioned above.

Flow of Foreigner Account Opening, Checking Procedures Between TPs & YSX

Contact:

Market Department

Tel: 01-371167